maine excise tax credit

California has the highest state-level. Your order will not be processed unless the payment has been received.

2022 State Tax Reform State Tax Relief Rebate Checks

We then used the resulting rates to obtain the dollar amount paid as real-estate tax on a house worth 217500 the median value for a home in the US.

. Qualified EV and FCEV purchasers may apply for an excise tax credit of up to 3000. An excise tax is a tax imposed on a specific good or activity. For the excise tax deposit rules see Pub.

We administer the real estate transfer tax commercial forestry excise tax controlling interest transfer tax and telecommunications business equipment tax and we determine annually the amount of tax reimbursement to each town for veteran homestead and animal waste facility exemptions and tree growth tax loss reimbursement. As we continue to look at tax types that can harm states post-coronavirus recovery its worth highlighting taxes on business inventory. Arizona transitioned from a four-bracket individual income tax with a top rate of 45 percent to a two-bracket system with a top rate of 298 percent a waypoint on the states transition to a 25 percent single-rate tax.

As of 2019 according to the Census Bureau. Much like a municipal assessors office the division maintains records of all property ownership in the UT and has over 700 UT tax maps. Florida collects a 6 state sales tax rate on the purchase of all vehicles.

Alcohol Dealer Registration Application PDF SECTION 9 - Certificate of Approval. Maine collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Excise Tax Credit Summary Report Revised 2019 PDF Claim for Credit of Excise Tax Report Revised 2021 PDF SECTION 11 - Brewery Winery.

Excise tax is defined by Maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. State Data Explorer. Unorganized Territory Property Tax Division PO Box 9106 Augusta Maine 04332-9106.

The tax rate for e-cigarette cartridges was originally set at 25 percent on wholesale but Senate Bill 382 lowered this rate to 15 percentmatching the tax rate for refillable vape productsbefore the higher rate could go into effect. Fannie Mae and Freddie Mac Exemption from Real Estate Transfer Tax PDF 4814. Tax Map with ownership listing - 500 each.

Maine Revenue Services temporarily limits public access PDF Maine Revenue Services Announces Limited Telephone Tax Payer Assistance PDF Maine Tax Alert - August 2022 PDF MRS Warns Employers of Tax Phishing Schemes PDF. Hawaii 444 percent Wyoming 536 percent Wisconsin 543 percent and Maine 550 percent. Efficiency Maines EV Accelerator provides rebates to Maine residents and businesses for the purchase or lease of a new EV or plug-in hybrid electric vehicle PHEV at participating Maine dealerships.

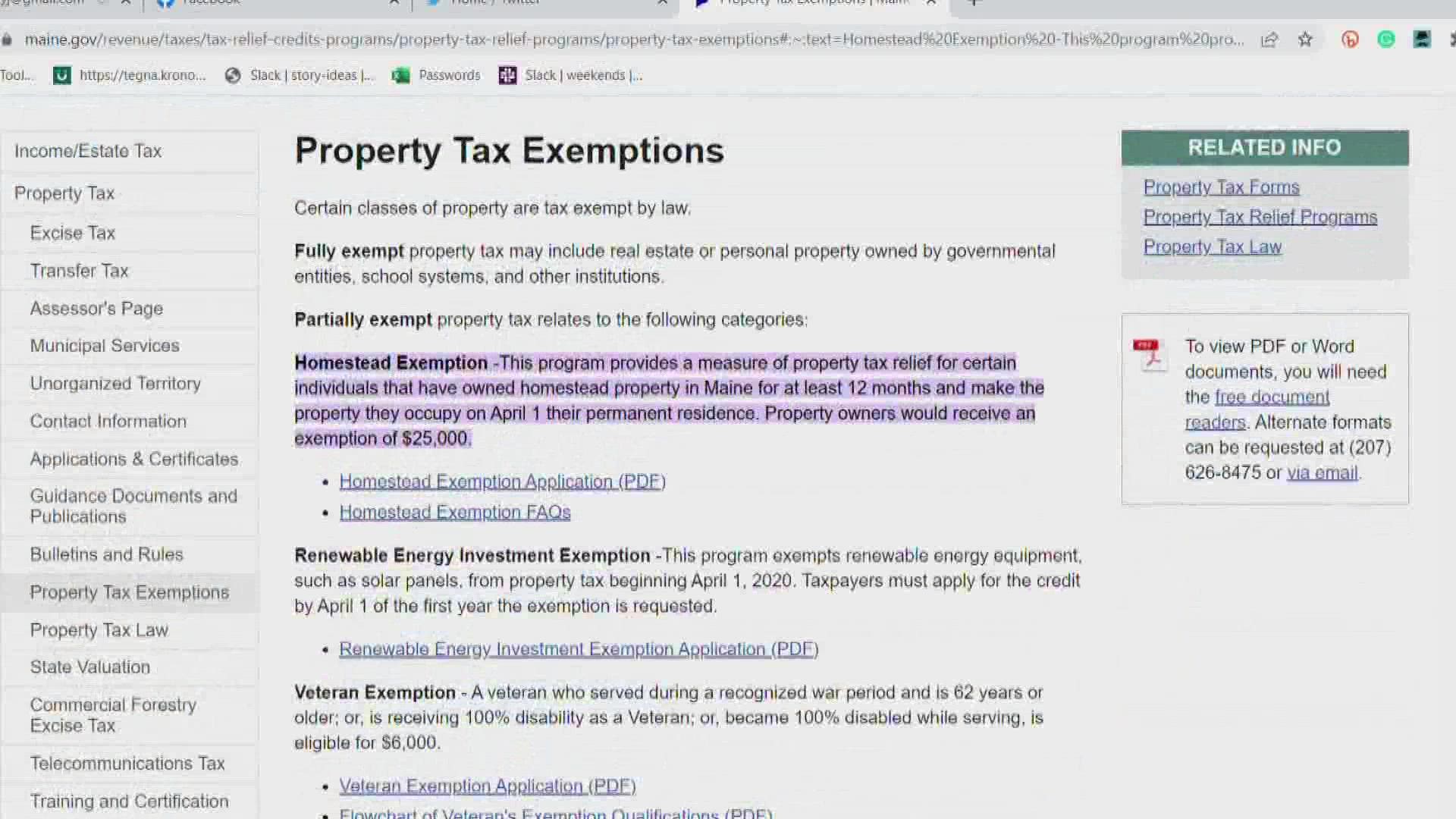

Partially exempt property tax relates to the following categories. The tax credit is first-come first-served and is. There are 23769 real estate tax accounts and 814 personal property tax accounts maintained by the.

Maines maximum marginal income tax rate is the 1st highest in the United States ranking directly. Individuals who live in Maine and Massachusetts have until April 19 2022 to file their 2021 Form 1040 or Form 1040-SR because April 15 2022 is Emancipation Day and April 18 2022 is Patriots Day. For real-estate property tax rates we divided the median real-estate tax payment by the median home price in each state.

Certain classes of property are tax exempt by law. However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in with a maximum tax rate of 15. Like the Federal Income Tax Maines income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Property Tax Utility and Other Municipal Payments This online service allows citizens to provide payment to their participating municipality or utility district for property tax utility and other bills. Excise taxes are commonly levied on items like cigarettes alcoholic beverages and gasoline. Business Equipment Tax Reimbursement BETR Program.

Homestead Exemption -This program provides a measure of property tax relief for certain individuals that. Modification of credit for prior year minimum tax liability of corporations. Oct 12 2022 Oct 12 2022.

Official website of the State of Maine. Fully exempt property tax may include real estate or personal property owned by governmental entities school systems and other institutions. Certificate of Approval Application PDF.

Aa Maines dependent personal exemption is structured as a tax credit and begins to phase out for taxpayers with income exceeding 200000 head of household or 400000 married filing jointly. Inventory taxes fall under the umbrella of the property tax which is the largest tax paid by businesses at the state and local levels. Beer was difficult to transport and spoiled more easily than.

It should be noted that the local tax is only applied to the first 5000 dollars of the cost of the vehicle. The Property Tax Division is responsible for annually assessing and collecting property taxes in the UT. Notable Ranking Changes in this Years Index Arizona.

The Whiskey Rebellion also known as the Whiskey Insurrection was a violent tax protest in the United States beginning in 1791 and ending in 1794 during the presidency of George WashingtonThe so-called whiskey tax was the first tax imposed on a domestic product by the newly formed federal government. CANNABIS EXCISE TAX Title 36 chapter 723 as enacted by PL 2019 c. An excise tax is a tax imposed on a specific good or activity.

FAQ about Coronavirus COVID-19 - Updated 472021. Kansas Policymakers Should Improve Food Credit Not Exempt Groceries. The BETR program is designed to encourage capital investment in Maine.

Modifications of limitation on business interest. Certain transfers are exempt from the transfer tax. Technical amendments regarding qualified improvement property.

548 2 is REALLOCATED TO TITLE 36 CHAPTER 725 4921 - 4925 Chapter 725. Transfer Tax Law 4641 Definitions. State Tax Changes Effective January.

Extended due dates for residents of Maine and Massachusetts. Free Online Real Estate Transfer Tax Filing Service PDF 8811. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax.

In addition to taxes on the value of buildings and land businesses can also pay property taxes on their. Mail the form and the payment to. 2022 State Sales Tax Rates.

Excise tax is an annual tax that must be paid prior to registering your vehicle. Temporary exception from excise tax for alcohol used to produce hand sanitizer. Please contact our office at 207-624-5606 if you have any questions.

This service is provided by a third party working in partnership with the State of Maine. Student Loan Debt Cancellation. 510 or the Instructions for Form.

2022 State Transportation Tax Changes Missouri. Enclose a check or money order made payable to Treasurer State of Maine. To qualify qualified business property must have been first placed in service in Maine after April 1 1995.

PESTICIDE CONTAINER FEE REALLOCATED FROM TITLE 36 CHAPTER 723 REPEALED 4941. Indianas tax on vapor products goes into effect on July 1. Improving Lives Through Smart Tax Policy.

Four Issues with Proposal to Increase Tobacco and Vapor Taxes in Maine. The program reimburses taxpayers for local property taxes paid on most qualified business property. 2020 Unemployment Compensation Income Tax Exclusion Instructions.

Excise Tax Trends. This registration is required for all Liquor Licensees in the State of Maine.

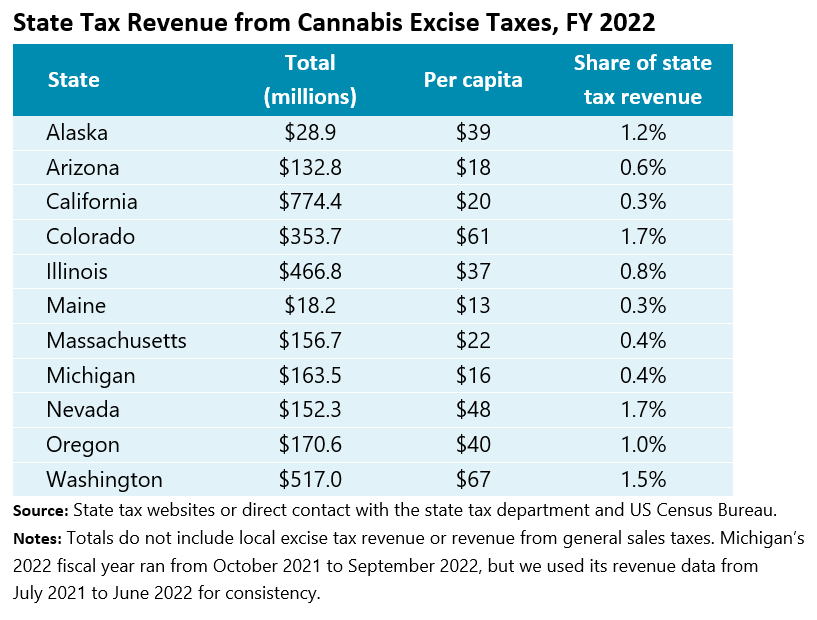

Cannabis Taxes Urban Institute

Bill Of Sale Form Maine Affidavit Of Exemption Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Another Proposal For Recreational Marijuana Sales In Maine Clears Legislative Hurdle Cannabis Business Times

Town Of Prospect Joins Motor Vehicle Registration Online Renewal Program Penbay Pilot

Setting The Stage For State Tax Overreach A Look Into Two Recent Laws Salt Shaker

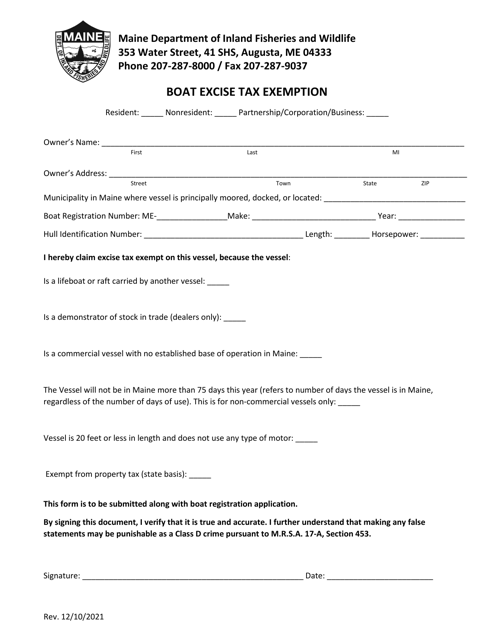

Maine Boat Excise Tax Exemption Download Fillable Pdf Templateroller

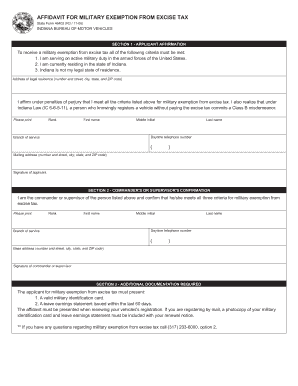

Maine Military And Veteran Benefits The Official Army Benefits Website

Motor Vehicle Registration The City Of Brewer Maine

Me Seed Capital Credit Worksheet Fill Online Printable Fillable Blank Pdffiller

How Do Marijuana Taxes Work Tax Policy Center

I Team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

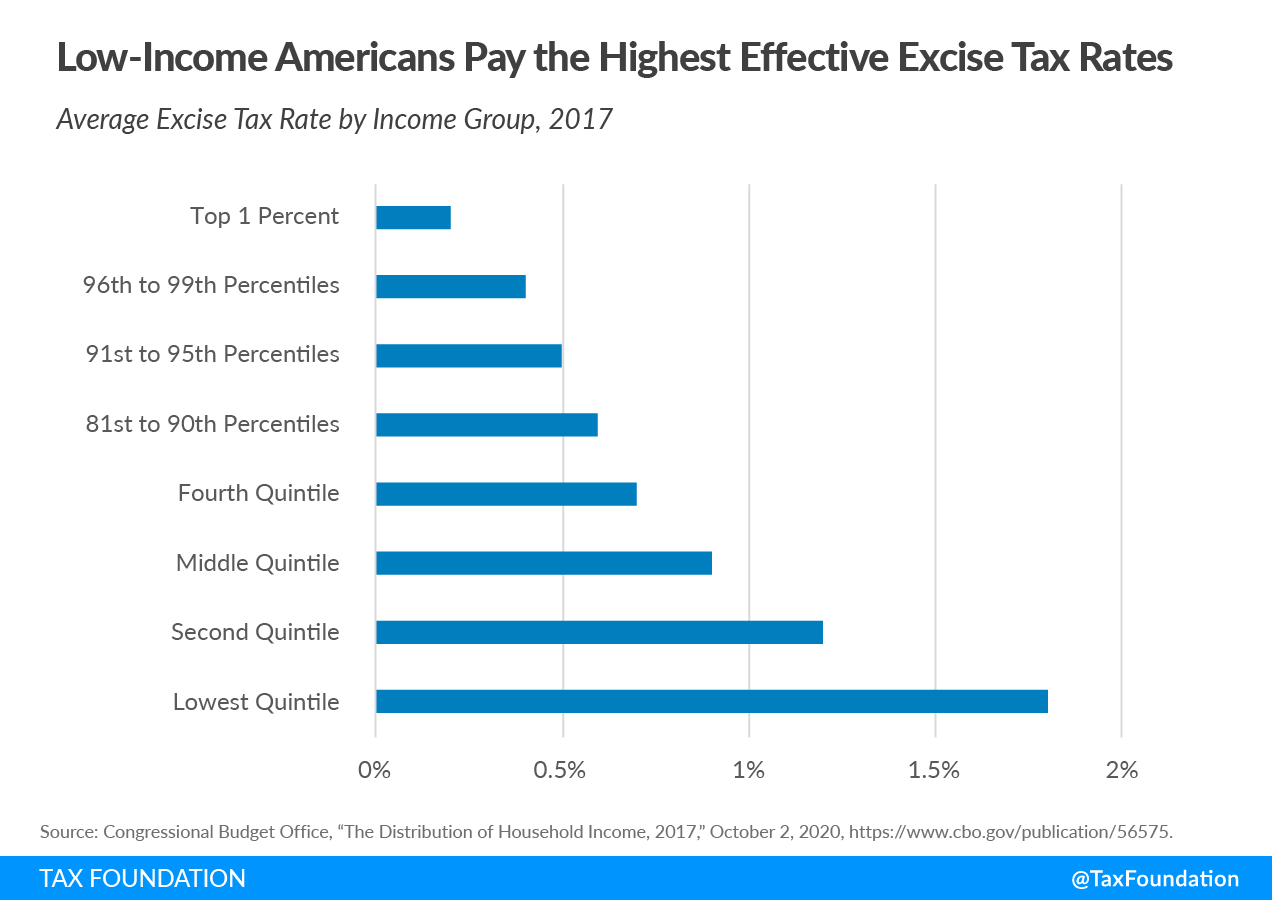

Excise Taxes Excise Tax Trends Tax Foundation

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Maine Car Registration A Helpful Illustrative Guide

Maine Revenue Services Form 700 Sov Fill Out Sign Online Dochub

Maine Income Tax Does Not Conform To Ffcra And Cares Act

Older Mainers Are Now Eligible For Property Tax Relief Newscentermaine Com